The Rise of Alts + How I'm Investing in 2021

Plus: Early access to my alternative investment community

Long time no email. We had our second child recently and life has been CRAZY! Let’s dive right in…

In today’s email:

2020: A look back at a few of the most interesting investing related developments from a wild year.

2021: How I’m thinking about investing in 2021 (asset allocation & my actual investments).

The rise of alts: My belief that alternative investments will continue to rise in popularity and find a home in more retail investors’ portfolios.

Early access to my new alternative investing community: I’m soft-launching a new investing community focused on alternative investments. Check it out here. If you’re interested in discovering and diligencing funds/deals in the venture capital, real estate, private equity or the collectible space, I think/hope it’ll be a helpful community. It is free (for now) and open to everyone (although accredited investors will benefit the most). P.S. Thanks to Curious Investor subscriber Pomp for re-tweeting and spreading the word about building it in public. 🙏

Investing related developments that I found interesting in 2020

Some large and seemingly small things that made me take note this year:

🏎️ Speed of both draw-down and market recovery

💸 Unlimited QE; Fed aims for 2%+ inflation

0️⃣ Near zero rates now and for the foreseeable future

🔮 Pull forward of the future in virtually all major aspects of our economy and society (e.g. ecom, healthcare, work, education, currency/money, and more)

📈 Legendary investor Jeremy Grantham notes a 90% allocation to VC + the rise of rolling funds giving more investors access to the venture capital asset class

₿ Bitcoin nears ATH. Institutions and big name investors seem to warm to BTC

🛡️ Vanguard announces product that will (eventually) allow retail investors to invest in private equity

Understanding the broad strokes of 2020 is helpful for me as I refine my asset allocation and think about investing in 2021. So what’s next after a wild year?

How am I thinking about investing in 2021

I can sum up my 2021 investing philosophy in two words:

OWN ASSETS!

My belief is that the next few years will be a phenomenal time for asset owners. Why?

✈️ Consumers want to CONSUME! Tons of pent-up demand for should drive the economy post-COVID.

💰 Personal balance sheets are strong. Consumers are sitting on cash they can use to consume. Check out this savings rate info to see what I mean.

🏛️ Janet Yellen running the treasury = market friendly policies.

💸 Material levels of inflation will cause asset prices to rise.

😑 TINA - “There is no alternative”. Cash locks you into a ~2% loss each year. Bonds yield nothing. Capital has to go somewhere; it will go into stocks and “alts” like real estate, venture capital, PE, and Bitcoin.

🔮 Pulling forward the future 10+ years should unlock greater innovation, efficiency, and growth.

The market conditions seem perfectly set up to reward asset owners. I realize an investment philosophy of “own assets” is far from earth shattering. And of course you need capital to own assets (that’s a whole separate topic).

That said, if you have a longish time horizon, good luck sitting on a bunch of cash and bonds. At least for now the 60/40 portfolio is dead. I suspect it’ll be far preferable to own assets that can appreciate and/or throw off income.

Obviously I don’t have a crystal ball and we could have always another black swan event like the pandemic. But as always, no risk no reward.

The Rise of Alternative Investments

One trend I see continuing is rise of alternative investments in retail investors’ portfolios.

What are alternative investments (aka “alts”) and why are they interesting?

Alts are essentially everything outside of public equities. Think real estate, venture capital, private equity, collectibles, and more. They tend to be illiquid and in some cases only accessible to accredited investors.

I’m not alone in seeing this trend. Austin Rief (co-founder of the popular daily business email Morning Brew) recently Tweeted the below:

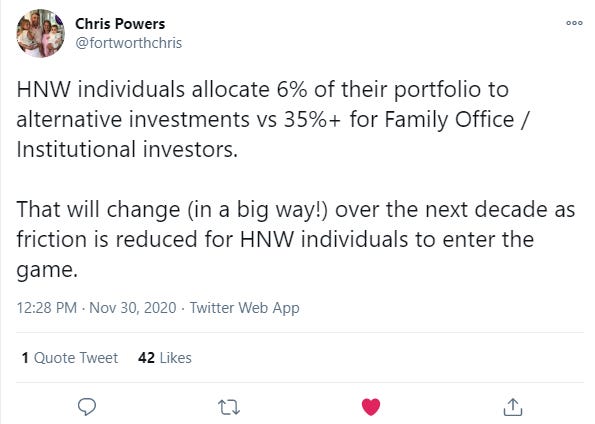

And here’s Chris Powers (Real Estate GP at Fort Capital general partner and also host of a great podcast) on the rise of alts:

Alt investment interest is seemingly everywhere. Dru Riley at Trends.VC had a short piece on the topic recently. Lastly, there was an absolutely fascinating Invest Like the Best episode with Leore Avidar. The whole episode is amazing but if pressed for time start at the 26:00 mark. Stay to hear the story of Leore buying the $1.5 million Lebron rookie and his new platform called Alt. I’m really excited to see what Leore builds with Alt.

Why even bother with alternative investments?

In many circles it’s contrarian to recommend anything other than low cost index funds. And I won’t argue low cost index funds aren’t great (they represent my single biggest investment).

But for many investors, I believe alts are really compelling. Many individual investors just don’t know yet how big of role alts could play in growing & preserving their wealth and/or don’t know how to access these investments.

Alternative investments are interesting as they can accomplish a few things in your portfolio:

Provide diversification

Reduce volatility

Potentially produce greater risk-adjusted returns

Provide yield

There is a lot more nuance here I will share in a future post but in my view there are real benefits to investing into alts.

If you look at the behavior of some of the sharpest capital allocators in the world you’ll see they invest heavily into alternative assets. Consider Yale for example.

The Yale Endowment

Here’s Yale’s asset allocation for 2021:

Notice anything?

Yale has a HUGE allocation to alts. They aim for up to 50% in alternative assets. These guys and gals are no dummies and there is a reason they allocate in this manner.

As investing gets further democratized I increasingly expect sophisticated individual investors to start allocating in a way more similar to endowments and ultra high net worth individuals. Said differently, more entrepreneurs, doctors, lawyers, and other professionals will start investing into alts.

If/when accredited investor rules loosen an additional tranche of investors will likely enter the space. This will further enable regular people to “invest in our culture” via the securitization of things like trading cards, video games, shoes, wine, and lots more.

Introducing The Alt Investment Community

👋 Say hello to Alt Investment Club.

Invest Like an Endowment

My belief is more and more individual investors will try invest like endowments.

Historically this is near impossible given the resources, network, and access endowments and large allocators possess.

But the world is changing in such a way that investing like an endowment is both possible and potentially more necessary.

A few reasons why more people will invest like an endowment:

Greater access to traditionally walled asset classes like VC. AngelList, via software and rolling funds has changed the game in this respect.

The internet (Twitter/podcasts) is connecting some of the best investors of today with capital from a whole new group of individual investors. Access and networks are online versus in a physical location like Silicon Valley.

The death of the 60/40 portfolio. The “40” will need to go somewhere and alts will play a role.

Rise of new platforms like Alt for trading collectibles.

Both the infrastructure and access is starting to change as investing in alts democratizes.

Investing in alts is hard | The benefits of a community

You might be thinking investing into alternative assets sounds interesting but aren’t sure where to begin.

I can relate to that feeling. After I sold my small e-com business I faced this problem. I didn’t want all our capital sitting in index funds but I felt like a total noob trying to invest in private real estate, venture capital, and private equity funds.

I found two challenging parts about investing in alternative investments are

Discovery: How do you even find a venture capital or real estate fund to invest in?

Diligence: Once you find an opportunity how do you know it’s worthy of your hard earned capital?

Building a community helps solve those problems. I’m really excited about the potential of a great group of entrepreneurs, builders, and investors coming together to collectively help each other learn, grow, and create more wealth.

Sign up here!

I’m interested enough in the alternative investment space that I spun up a new community around it. I’d love to have you be a part of the crew! Here is the link:

The famed Tiger 21 is my inspiration with a more modern twist. I can promise we’ll never have a $30k per year member fee or a net worth requirement of $10 million. I do hope in time to have a great community of investors that help each other with deal flow, diligence, financial education, and anything else that lives at the intersection of life and money.

For those interested in alts please sign up (it’s free for now). My hope is the community helps you become a better investor and connects you to some incredible people.

My 2021 Asset Allocation

I debate even sharing this as I’m not sure how helpful it is but people seem to like this sort of thing.

My updated 2021 allocations are below.

If you jump into the community you’ll see I posted the spreadsheet that I use to track our asset allocation (as well as a host of other things I track to keep our financial health in order). Feel free to download and use if helpful.

Everything is different but nothing has changed

In many ways, nothing changes for me 2021. I made some tweaks to our allocation recently but it’s not that different from a year ago. Asset allocation isn’t something that should be jumping around wildly from one year to the next. Make a sound plan. Stick to the plan.

Target Asset Allocation - Q1 2021

Stocks: 50%

Real Estate: 20%

Cash: 10%

Venture Capital: 7.5%

Bonds: 5%

Micro PE: 5%

Crypto: 2.5% (80% BTC; 20% ETH)

If you hop into the club you can see exactly what real estate, venture capital, and PE funds I’m in. I share the “why” behind my investment which may be moderately interesting or helpful.

Wishing everyone a great last month of this unforgettable year.

Thanks for reading and happy investing,

-Paul

Thanks for reading the curious investor. If someone sent this your way, or you haven’t done so yet, sign up below so you never miss an update. Thanks again. ✌

👋 Say hi on Twitter

🎧 In my headphones now: “Back from the hospital” | Hot Sugar

📧 Click the green button below to share with a friend

🧍 Who are you again? Hey my name is Paul. “The Curious Investor” is a newsletter where I write about investing and the intersection of life & money. In addition to investing, I spend a lot of time in the ecom world. I started and sold an ecom business and now help brands grow big on Amazon. Previously I was a CPA and spent a decade in corporate finance. Learn more about how I invest here. I recently started AltInvestmentClub for people interested in investing into real estate, venture capital, private equity and other alternative investments. Nothing herein should be considered investment advice.

Nice article Paul. Just registered for your group, can’t wait to learn and share. There’s a site called Otis that sounds similar to Alt. I am just dabbling in it to familiarize myself. Also have been testing comics and cryptos in the past three years. Learned some lessons the hard way that I will share.

This is awesome, Paul. I work and invest in Alts - specifically real estate. What is your openness for being pitched investment opportunities? Thanks again for this information!