My first VC investment

Twitter, solo-capitalists, rolling venture capital funds & the democratization of VC

This past weekend I became a LP in Sahil Lavingia’s new VC fund.

If you don’t know Sahil, here is the cliffs notes version of his bio:

Employee #2 at Pinterest

Left Pinterest to start Gumroad where he raised money from some of the biggest names in VC (you can read his thoughtful reflections on failing to build Gumroad into a billion dollar company here)

Has a large and engaged following on Twitter (110k followers)

That fact I’m a LP in a new fund isn’t particularly interesting.

What I find interesting (and hopefully you will too) is a few aspects of the process that led me to become a LP in Sahil’s fund and what that means for other small/solo investors. Here are the highlights which I’ll unpack in more detail below:

How I found Sahil’s fund (hint: thanks Twitter!)

The ‘diligence’ process (hint: thanks YouTube & Notion!)

The concept of emerging solo-capitalists (hint: thanks Substack!)

The benefits of rolling venture funds (hint: thanks Angelist!)

The democratization of of venture investing (hint: thanks internet!)

#1) How I found Sahil’s fund

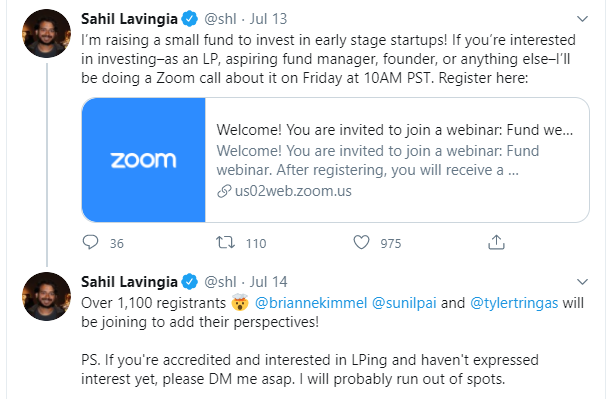

On Friday I saw the following Tweet:

I’ve heard Sahil on a few podcasts and found him to be a smart, thoughtful, and interesting guy. Since I’ve been looking to allocate a few bucks to venture, Sahil’s tweet sufficiently hooked me.

Time to do a little diligence…

#2) My due diligence process

Until a few years ago I didn’t even know what a ‘LP’ was and certainly didn’t know anything about performing diligence on a fund.

Through some practice I’ve developed my own little diligence process. Generally that process is to try and understand the people behind the fund. Obviously the thesis is important, financial models can be important, etc. But at the end of the day all that stuff can be dressed up and manipulated. Generally you’re betting on a person and their track record versus whatever fancy deck someone walks you through.

My diligence for Sahil’s fund was quick:

I watched this YouTube video

I read this Notion memo

I re-familiarized myself with Sahil’s background

The internet allowed me to pretty quickly ‘get it’. I saw his Tweet Friday and by Saturday I was good to go.

#3) Solo Capitalists

A couple weeks ago Nikhil Basu Trivedi put out a newsletter called The Rise of the Solo Capitalists. It’s a really good read if you’re interested in venture.

The short version is the next wave of VC rock stars could come from small, nimble, and actually useful to founder GP who have their own brand. Nikhil calls these solo GPs ‘solo capitalists’. Sahil fits that description.

Here’s an excerpt from the post…

The Biggest Threat to Venture Capital Firms?

I was on a phone call with a very sharp LP several months ago who brought up the solo capitalists and posited that their rise may be the biggest threat traditional venture capital firms have seen in a long time.

Why?

The importance of an individual's brand has been steadily increasing in venture capital for quite some time. Founders are more often than not picking an individual partner who they want to work in a financing round, based on the relationship built with them, and based on their brand and expertise, instead of the firm's.

So it's a logical next step that the firm is the individual, and the brand is the individual, which is the case with the solo capitalists.

Solo capitalists can make much faster decisions than most traditional venture partnerships. Founders only have to interface with one person, which can have its benefits.

Solo capitalists can be more flexible on ownership, on structures like board seats, and more creative in terms as a result of being sole decision-makers.

And because it's unlikely that their fund sizes can balloon dramatically in size, the solo capitalists may generate higher multiple returns on their funds.

I found the argument pretty compelling.

Another aspect that makes this interesting for solo LPs is you might actually have a chance to get in the game. Big name VC’s won’t even reply to your email when you’re looking to put in a small check. They don’t need your $100k.

But solo capitalists can start small and raise a fund off of Twitter and their network. These emerging GPs starting their first micro fund can be a great match for a small time solo LPs.

With regards to Sahil, I especially like he doesn’t have some goofy logo or fancy fund name. It’s beautifully void of the usual b.s.

#4) Rolling Funds

I subscribed the Sahil’s fund via Angelist like you’d subscribe to Netflix. And there is no Fund I, Fund II, Fund III, etc. Instead the fund rolls on and on. As long as I’m subscribed I get a slice of any deal in that quarter. It’s a pretty unique model and better for both GPs and LPs in my opinion.

Here’s a few of the GP highlights from Angelist:

The biggest friction for fund managers is the process of big-bang fundraising. Here’s why:

Fund managers need to raise their entire fund's capital in a short period of time. This type of big-bang fundraising is stressful. Some fund managers take longer than expected to complete the raise, causing them to lose out on great investments.

Fund managers can’t raise additional capital during their most marketable moments, like portfolio markups. This causes them to miss out on closing new LPs until their next fundraise, which can be 2-4 years later.

This recurring nature of capital commitment allows fund managers to:

Raise a fraction of a traditional fund and start investing in startups right away

Leverage portfolio markups to accept new capital, anytime

Continuously increase the fund size so they never need to raise another fund again

For LPs it’s a win too. Instead of sitting on cash wondering when you’ll get the capital call, you instead know exactly when and how much is going into the fund.

#5) The democratization of VC

Access to the best VC funds has typically been reserved for the well networked insiders.

The most interesting thing about solo capitalists, rolling funds, and the internet in general is that it levels the playing field. The best VC funds of tomorrow could be from the solo capitalists.

And the capital could come from almost anyone (hopefully the accredited investor rules change to allow greater access for everybody). I’m here in the midwest with zero connection to Silicon Valley. Yet thanks to the internet I can get in the game.

Being a person of the internet can open up all sorts of opportunities. It certainly creates possibilities for creators and those with an audience. If you have the distribution the product will follow whether that’s a book, album, or even VC fund.

It also creates opportunities for smaller investors; if you have a bit of capital you can find a home for it more easily.

I’m excited about the future of VC investing for small solo LPs and emerging solo capitalist GPs. Capital can better flow to people and projects that can build a brighter and more interesting world.

As always, would love to hear you thoughts. I’m still very much learning about this world so hit me up with any thoughts or comments.

-Paul

Thanks for reading the curious investor. If someone sent this your way, or you haven’t done so yet, sign up below so you never miss an update. Thanks again. ✌

👋 Say hi on Twitter

🎧 In my headphones now: “Learning to Fly” | Tom Petty

📧 Help me grow by clicking the green button below and sharing. Thanks 🙏

🧍 Who are you again? Hey my name is Paul. “The Curious Investor” is a newsletter where I write about investing, personal finance, markets, and financial independence. In addition to investing, I spend a lot of time in the ecom world. I started and sold an ecom business and now help brands grow big on Amazon. Previously I was a CPA and spent a decade in corporate finance. Learn more about how I invest here. Nothing herein should be considered investment advice.