Start a Blog & Sell It for $15 mil? Plus: Buffett vs Robinhood, VC vs Bootstrappers, and the "V" Chart

Also: My blog fail | Welcome to the roaring 20s?

Hey everybody. Here’s what I’m writing about this week:

💸 A fifteen million dollar personal finance blog is up for sale

💻 My blog fail and Forbes article

🥾 Taking VC $ vs Bootstrapping

📈 Charts. “V” for Victory?

🚀 Buffett Rocked by Robinhood

1 Man. 10 Years. $15 Million?

Check out this listing for a personal finance blog that just popped up on QuietLight Brokerage.

Key points…

Guy starts blog in 2009

He aims to work three hours a day on the blog

A decade after starting out, his business makes over a million a year and he lists it for sale for $15 mil. Pretty sweet.

From the listing:

In the case of this seller, he has a goal of working 3 hours per day. He rises early to put a couple of hours into writing and various other updates that need to be done on the business. In his words, he has been “a one-man band” since the beginning and he’d like to spend more time with family and mainly focus on writing.

I didn’t sign the NDA to get more info on the listing but speculation on the internet is that it’s for a popular personal finance blog called Financial Samurai.

Putting one foot in front of the other

A 9.5x multiple is really rich for a content site. Not sure it’ll get close to fetching that price. I suspect the angle is that the new owner can come in and monetize the site up with credit card affiliate offers as they’re highly lucrative. Perhaps a strategic buyer will see value but I’d guess strategics already were floated this before it went live on QLB.

Either way, kudos to the man behind the Financial Samurai. With nothing more than bits and bytes on a personal computer he’s created a business that will sell for millions. Reminds me how powerful putting one foot in front other can be when you’re lined up at the right target.

My Blog Fail

When I sold my business I spent some time trying to figure out “what’s next?”.

After some deliberation, one of the “what’s next” things I settled on was starting a blog. I’m fully aware to many people “starting a blog” sounds like a very last decade thing to do. But I like to write about personal finance & investing and thought I could run the same play that many others were having success with.

So how’s it been going?

Not so good. To date, consistent traffic to the site I built (WealthFam) has been minimal. The returns on my time and money are most certainly negative at this point. I’m not totally resigned to walking away from it but I’ve come to the realization I have some challenges with the blogging business model.

My challenges with blogging:

Blogging essentially requires you to write for content aggregators (i.e. Google & the algorithm) as opposed to a person

Blogging doesn’t have an immediate feedback loop. It takes a long time to rank in search results and in turn requires major persistence even when rewards are years away (if ever)

Blogging requires content creators to do annoying stuff like courting backlinks from high authority sources

If you’re just blogging for fun most of those challenges fade away. But if you want to make a business of blogging you have to factor in all of the above.

Substack = going around the aggregators

Ben Thompson was on the “Invest Like the Best” podcast this past week. Awesome episode from a really clear thinker. Ben’s built an influential and lucrative content business analyzing tech by going around the aggregators via his newsletter (Stratechery). If readers like his work they buy a subscription. And if they don’t they can fire him and unsubscribe.

The big challenge with this model is finding an audience but to me it resonates more deeply than trying to write everything with Google in mind. I still think blogs are powerful but am more eyes wide open now than before.

My Q&A in Forbes

Back when I was dipping a toe into the backlink game I got connected to a Forbes writer. They were interested doing a feature on my story of building a business and hitting FI.

Check it out here if interested.

The easier path to wealth… venture startup or bootstrap startup?

This thread from Andrew Wilkinson received a lot of buzz on Twitter with the likes of Chamath Palihapitiya, Paul Graham, and Ben Evans all weighing in.

The question: If your goal is building wealth would you rather take VC money or bootstrap and compound your own capital?

I’m generally with Andrew and Chamath on this one. My own business likely would have been a venture flop and flamed out leaving me with nothing. Taking my initial $5k and compounding it while owning 100% was the right play for me.

Fun thread if you’re starting a business or just want to see a good debate about venture vs compounding your own capital.

Yawn… S&P 500 Almost Flat YTD 🥱

What a boring year in the stock market right? Year-to-date the S&P 500 is down a mere 1.9%. When you factor in dividends the S&P is down even less.

It almost feels jarring to see the market rocket higher while we face a global pandemic, massive unemployment, a recession, and civil demonstrations about racial inequality. It can feel like the market exists in an alternative universe to what we see on Twitter day after day.

Here’s the S&P YTD chart where you can see the V shape in full effect.

S&P 500 YTD Chart - V for Victory?

As this piece from the New York Times mentions, the markets only care about one thing: profit.

”The stock market judges many things,” said Edward Yardeni, the economist, who runs an independent market research firm on Long Island. “But morality isn’t one of them.”

“If you want to find morality, don’t look at the stock market,” said Richard Bernstein, who runs his own investment firm in Manhattan.

The market is focused, as always, on one paramount concern: profit. That may well be repulsive in a moment of intense and widespread human suffering, but it is consistent.

Time will tell. Is this the ‘V’ for Victory and it’s off the races for the roaring 20’s 2.0? Or are we hitting the midpoint of a ‘W’ shape with more pain ahead? I’ll keep one foot in each camp with a mix of equities and cash.

Markets: What I’m Watching For This Week

Fed Meeting: This week the Fed meets for the first time since the US started to reopen. The meeting begins Tuesday with a statement out Wednesday afternoon. If investors like what they hear from Jerome Powell we could easily go green for the year on the S&P. I doubt JP will want to do anything to disrupt the market and, given there are still major concerns about the underlying economy, I think the odds are good the market hears what they want to hear come Wednesday.

Continued rotation into cyclicals: The reopening stocks have been flying lately as tech has lagged. BRK.B was my latest add in my fun money portfolio as I sensed this rotation would occur at some point but I’ve been surprised as how fast and how strong the rally for re-opening names has occurred. If we stay on track with re-opening and COVID data doesn’t surprise it seems likely this rotation will continue.

Buffett getting rocked. Robinhood rocking.

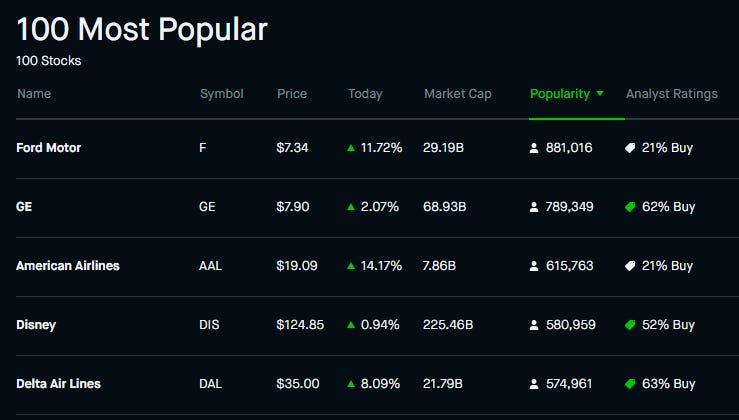

Take a look at the five most popular stocks on Robinhood:

Notice anything interesting? Airlines make up two spots on the top five list. Note: to see the full list click here.

Airlines have been on fire lately as the market has rotated into re-opening stocks.

Buffett Flops Again

If you can remember all the way back to April, you might recall Buffett dumping his entire stake in airlines.

“The world has changed for the airlines. And I don’t know how it’s changed and I hope it corrects itself in a reasonably prompt way,” he said during Berkshire’s annual shareholder meeting Saturday, which was virtual this year. “I don’t know if Americans have now changed their habits or will change their habits because of the extended period.”

Buffett has had a rough go recently. Here are a few notable misses:

Kraft Heinz

Occidental Petroleum

Airlines

Banks

Airlines and banks have both bounced back big since Warren sold out of his positions. Buffett may have bailed near the bottom but guess who jumped in? Retail investors.

Retail investors nail the bottom

That’s a wild chart. Twenty-something Robinhood traders beating up on Buffett isn’t something you see everyday.

What does it mean?

Investing is hard and even the legends don’t bat 1.000.

More broadly, to me, something feels a little too exuberant in markets at the moment.

It’s an interesting moment in investing culture. We’ve got Robinhood traders, Davey Day Trader, and the Wall Street Bets crowd playing loose and fast and seemingly outperforming Buffett and other legendary investors.

It feels a bit like when Bitcoin rocketed to $20k a few years ago. There was so much FOMO, so many new people getting into it. That same feeling of gambling and speculation gives me a bit of pause on where we sit right now.

That said, I wouldn’t bet against this market as it seems to be climbing the proverbial wall of worry. The momentum feels strong. And we’re still in a TINA environment. Yield is hard to come by. The money has to go somewhere.

Moments like this are why it’s never a bad idea to have a plan around asset allocation. Sticking to your AA takes a lot of the emotion out of the equation. I’m glad to have some cash on the sidelines in case things get weird.

Funny Investing Tweet

Pretty pretty good…

Thanks for reading.

-Paul

👋 Say hi on Twitter

🎧 In my headphones now: “Still Feel It All” | MARO

📧 Help me grow by clicking the green button below and sharing. Thanks 🙏

🧍 Who are you again? Hey my name is Paul. “The Curious Investor” is a newsletter where I write about investing, personal finance, markets, and financial independence. In addition to investing, I spend a lot of time in the ecom world. I started and sold an ecom business and now help brands grow big on Amazon. Previously I was a CPA and spent a decade in corporate finance. Learn more about how I invest here.